[Update 24 – 30 May 2015]

Whilst poking about the internet yesterday, I visited the King World News propaganda mill and came across this Eric King interview of Paul Craig Roberts: Former U.S. Treasury Official Dr. Paul Craig Roberts Warns Black Swans Will Engulf The World: “It’s A Perfect Storm”…

In past entries, I’ve pointed out Paul Craig Roberts (PCR) as a prototypical Team BRICS propagandist, and many have taken note of the Hidden Hand gang sign he flashes on his website…

…If you pair this symbolism with the flavor of propaganda he puts out, any observant person can see exactly where his true loyalties lie: with the Hidden Hand Occulted Powers (the “royals,” Rothschilds, Rockefellers, etc.) and the dialectic scam they’re running to sell their New World Order. Given that he has been positioned as a high-level “respectable journalist,” he is a very good source to watch when you want to back-engineer your way to the truth.

That being said, let’s have a look at what he’s trying to sell us in the interview…

1) Austrian Economics: the interviewer and PCR go out of their way to put in a plug for Austrian Economics…

>>> Eric King: “Because you were called in along with others to save the United States from collapse when President Reagan came into office, as you watch us push closer and closer to the wall that Austrian economics warns us not to approach, if you had to speculate, what is going to begin to cause this whole (Ponzi scheme) to collapse?”

Dr. Roberts: “Well actually, Eric, we’ve climbed over that wall that the Austrians warned us against. (LAUGHTER). We’re not just getting close to it, we’ve already climbed over it. <<<

Austrian Economics is the economic ideology the Occulted Powers intend to implement as part of the Solution phase of the Problem / Reaction / Solution scenario we’re currently undergoing. If you are a new reader, you might want to have a look at Update 14 and Update 15 to see who is behind the development and adoption of Austrian Economics (the “royals” and the Rockefellers).

2) The “American Empire” myth: PCR implies that the US government is trying to maintain and expand an American Empire…

>>> I think we’ve miscalculated in thinking, Eric, that we could have Russia and China as vassal states. They’re not going to be vassal states. Therefore, this realization on the part of Europe could affect Europe’s toleration of their own vassalage to the United States. <<<

The truth, of course, is that America never built an empire; the globalist central bankster families did (the Rockefellers, Rothschilds, et al. built the NWO using America as their expendable tool). And the United States, Europe, Russia and China are ALL under their vassalage. This is evidenced by the fact that all these nations are tied into the G20 and are implementing the Basel III banking regulations (which are tied in to the Bank for International Settlements). Even China’s own propaganda organs admit to their central bank’s subservience to the Basel globalists: Mainstream propaganda reveals East/West conflict is a farce.

3) The “Washington is doing all this because they’re stupid” lie: PCR attributes the US government’s recent self-defeating and outrageous behavior to simple stupidity/incompetence…

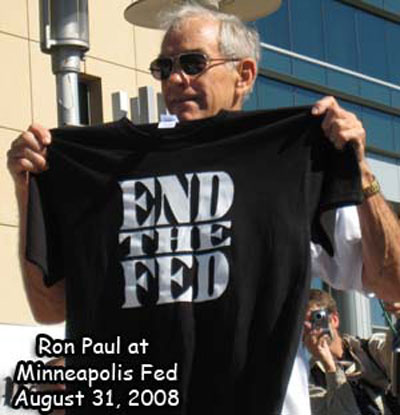

>>> So then you have to ask yourself, ‘Why didn’t Washington, which is so empire-crazed, tell the EU, ‘Leave Greece alone’? Or why didn’t the Fed just print the money to bail out Greece? If they will print the money to bail out JP Morgan, Citibank, Goldman Sachs and the British banks, why can’t they print the money to bail out Greece and get rid of the problem? That just shows how stupid they are. They get more pleasure out of oppressing people, in this case the Greeks, than they do in saving their own empire. So this thing can blow up at any time…

The scariest thing about the United States is the complete absence of any competent leadership. There’s not a single competent leader in the political system. And if you look at the people who are announced as contenders for the presidential nomination in the next election, you are looking at a gaggle of maniacs. These are people who haven’t got enough sense to be let out of the house on their own. And this is a superpower — ruled by idiots! This is the danger. And this is why I don’t think the United States has a future. <<<

“They’re doing it because they’re stupid/incompetent” is a very common propaganda ploy of the Establishment media. Whenever the government, the Federal Reserve, or any other Establishment institution acts in ways that seem contrary to its respectable, publicly-pronounced raison d’etre, the Establishment media always blame it on stupidity or incompetence. In reality, however, these institutions know exactly what they’re doing and it’s all on purpose. They are pursuing their real agendas, not the textbook agendas they program the public to believe they pursue. Nothing — not the US government, the FBI, the CIA, the Federal Reserve, the UN, etc. — exists for the reason the public is given.

The seeming insanity of recent US government policies is not the result of stupidity or incompetence; it is all very deliberate, and it’s intended to make the West look bad and the East look good. So when the “wise” BRICS leaders sweep in to wrest control of the UN/IMF/World Bank from the “insane” Western leaders, people are expected to accept that the “new management” will finally make these institutions work like the textbooks say they should. Unfortunately, though, the globalists built the BRICS and wrote the textbooks, so the whole setup is an increasingly transparent scam.

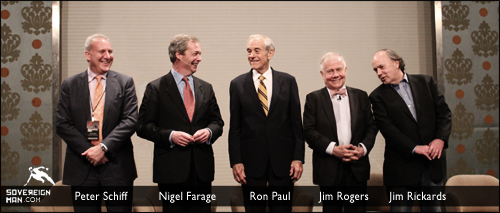

Once UN/IMF/World Bank“governance reforms” are enacted by the “heroic” BRICS, watch for controlled opposition agents like Paul Craig Roberts and Ron Paul to temper their criticism of those institutions. “We supported shutting down the UN/IMF/World Bank because they were instruments of the American Empire used to bully the world,” they will say, “but now that they’ve been reformed to be truly balanced and democratic, perhaps these organizations can finally live up to the high ideals they were supposedly built to uphold.”

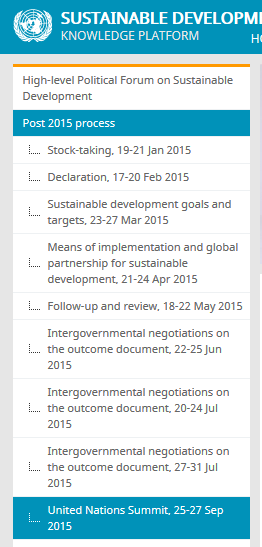

As the upcoming East versus West climax approaches, remember that the main purpose behind the whole drama is to rejuvenate the UN brand. In the course of building the New World Order, the UN/IMF/World Bank name has become tarnished, so an “Under New Ownership/Management” sign is needed to lure people back to their brand. The BRICS-induced “governance reforms” will provide the fresh coat of paint the UN will need to gain public acceptance.

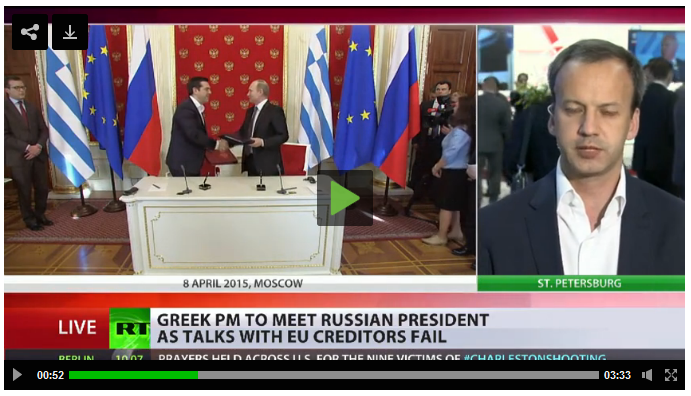

Getting back to the interview, PCR also confirms that Greece is the tipping point for the takedown of the Eurozone and the US…

>>> The End Of The American Empire

You could see the empire disintegrate. All it takes is one European country to leave the EU and NATO and the American empire ends. That’s all it takes. Now we see who that could be — it could be Greece.

We’ve talked about this before. If the Greeks say, ‘Look, our European partners don’t give a damn about us; they’re going to press us into the ground. So we’re defaulting,’ and then they turned to Russia, that’s the end of the American empire. <<<

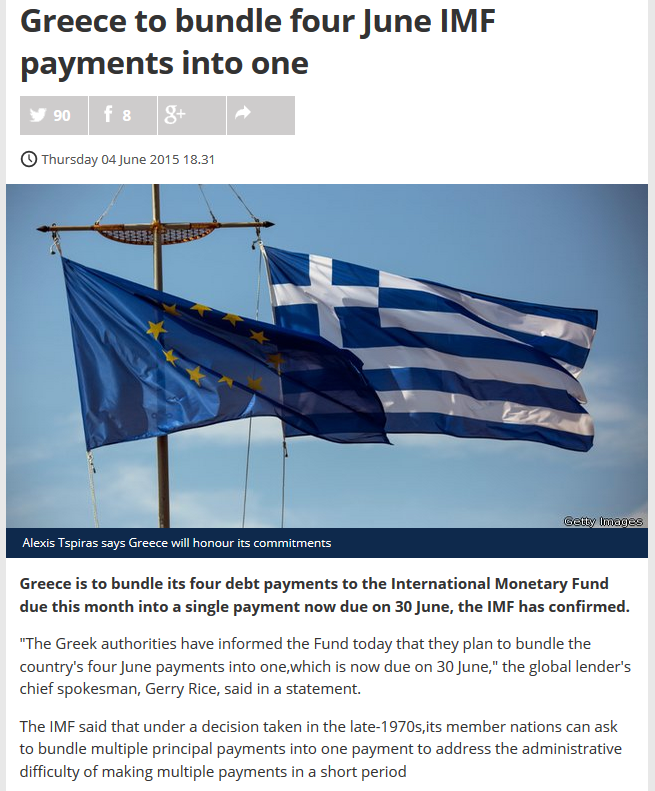

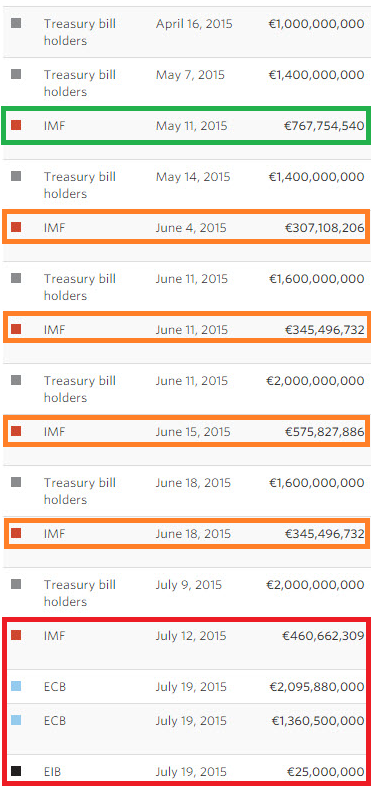

The unfolding of the globalists’ Greece strategy is outlined in Updates 13, 18, and 19. And as we enter the June 4-18 time window next week, we must watch the Greek situation very carefully. If the globalists allow the Greek default to happen, we know it’s “game on” for the takedown this year. On the other hand, if a miraculous deal is reached with Greece’s creditors or the Russians suddenly prepay for Greek pipeline rights, the globalists are pushing the pause button. Given some indicators I’ve been seeing, it’s hard to imagine them not going for it this year.

There have been rumors that the Greeks might scrape together the first payment in the June 4-18 series of payments, but all that means is that the globalists are squeezing the last little bit of cash out of the Greeks before they crash them. Syriza will strip-mine every possible dime from the Greek populace before they trigger a default. Why leave money on the table?

While we’re on the subject of globalist disinformation sources, if you want to see the best examples of the lies being sold to awakening public, I recommend watching these three sites:

1) Paul Craig Roberts, for the “mainstream alternative” lie.

2) One World of Nations, for the “rabbit hole alternative” lie.

3) Golden Age of Gaia, for the “rabbit hole spiritual” lie.

When/if you go to these sites, ask yourself, “What are they trying to sell me and why?” To find the truth, start by flipping their lies upside down.

[Update 25 – 31 May 2015]

Beware the “Former” Insider

Paul Craig Roberts selling the phony East vs. West conflict…

One of the great things about regular folks like you and me is that we are generally trusting and ready to take a person at his/her word. Unfortunately, this great quality is also a great weakness when dealing with people with forked tongues and impure aims, like the globalists. To help us get past this self-destructive habit of extending unearned trust, allow me to offer…

Ken’s First Rule for Not Being a Sucker: When a “former” insider comes forth to offer you information and interpretation, don’t discount the likelihood that the former insider is a current insider tasked with misleading you.

This would seem to be a rather commonsense rule, but for some reason it is ignored when “insiders” bend our ears to tell us supposed secrets and give us a heads-up on what’s really going on and what it means. The alternative media is chock full of talking heads who are purported “former” insiders at the FBI, CIA, NSA, World Bank, Treasury, Wall Street, and so on. There are even some purported current insiders who go through the rube-impressing pretense of disguising their voices and using code names. And what are virtually all of these guys telling us? They tell us how bad are the US and the West while either ignoring or promoting China and the East. In other words, they are establishing the Bad Cop and the Good Cop so the globalists can run their governance reform scam.

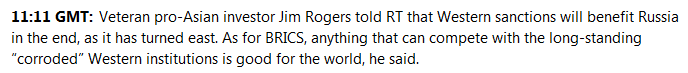

Take Paul Craig Roberts for example:

> He is a former Assistant Secretary of the Treasury for Economic Policy.

> He is a former editor at the Wall Street Journal.

> He was the “first occupant of the William E. Simon Chair for Economic Policy at the Center for Strategic and International Studies [CSIS], then part of Georgetown University.” It’s worth noting that Georgetown is a Jesuit institution, and the Board of Trustees of CSIS includes Henry Kissinger, Zbigniew Brzezinski, and representatives of Exxon Mobil, Boeing, Coca Cola, AIG, GlaxoSmithKline, and Morgan Stanley (to name a few).

Looking at the high positions this guy has held in the Washington/Wall Street Establishment, ask yourself this: “Is PCR really going against all of his lifelong associates or is he simply carrying water for them like he always has?” If you put together his background, his gang sign, and the nature of his information, what does common sense tell you?

[Update 26 – 1 June 2015]

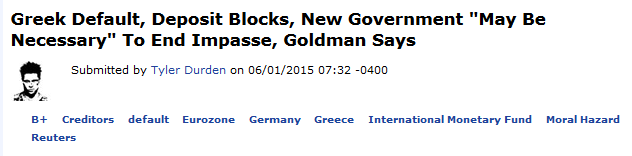

Goldman Sachs issues preparatory propaganda for the Greek pivot

During this morning’s infoscan, I came across this article on Zero Hedge…

…which contained a telling passage…

>>> …On the other hand, the Greek government was elected on a platform that promised continued membership of the Euro area but without the austerity, adjustment and oversight that came with the troika programme. Departing from this position requires a change in the political mandate on which the Greek government operates…

Euro exit is a political decision. For sure, the Greek authorities could decide to exit in a unilateral manner. But the current Greek government has no mandate to do so: if it announced an intention to leave the Euro area pre-emptively, in our view the government would likely fall. Moreover, there is no process for Euro exit defined in the governing European treaties: the practical and legal challenges could not be resolved overnight…

Viewed first through a political lens, this situation serves to clarify the choice facing the Greek economy. Under the maintained assumption that the European authorities do not give way on their three key principles listed above, the intensification of the liquidity shortage will demonstrate that the platform on which the current Greek government was elected is simply infeasible: the Greeks cannot “have their cake and eat it”, retaining the Euro but not implementing adjustment. A hard choice has to be made between (a) Euro exit and (b) adjustment to remain part of the single currency. Making that choice entails finding a new mandate to govern. This will have to be sought from the electorate, implying a new government, new elections or a referendum (or various combinations of the three). <<<

Back in February/March, I wrote about this scenario in Update 19, The Greek “People’s Revolution” and the New European Renaissance, brought to you by the NWO. I covered how a government shakeup was being engineered to produce a shift to the political right (and more specifically to Panos Kammenos, “the Greek Nigel Farage”). Here is an excerpt…

>>>>>> Have a look at this Reuters article: Greek defence minister says Greece has Plan B if EU rigid on deal…

>>> Greek Defence Minister Panos Kammenos said that if Greece failed to get a new debt agreement with the euro zone, it could always look elsewhere for help.

“What we want is a deal. But if there is no deal – hopefully (there will be) – and if we see that Germany remains rigid and wants to blow apart Europe, then we have the obligation to go to Plan B. Plan B is to get funding from another source,” he told a Greek television show that ran into early Tuesday. “It could the United States at best, it could be Russia, it could be China or other countries,” he said. <<<

So as the Greek crisis reaches its crescendo, Syriza will disintegrate and the Greek government will fail. And when a civilian government fails, who typically steps in to maintain social order? The military, right? And who is the leader of the Greek military? Defense Minister Panos Kammenos.

Kammenos will step up to maintain some semblance of order in the wake of Syriza’s disintegration and will go to his friends in Russia to secure aid from the freshly-launched New Development Bank (NDB, the BRICS Bank — the BRICS will be holding their 7th summit meeting in Russia on July 8–9, and will likely announce the NDB’s launch at that time). An emergency election will then be held to install a new Greek parliament that will restore the drachma and approve the NDB loan. Since this will occur at about the same time as the next financial crisis begins, it will be the first domino in the fall of the EU. From the ashes of the EU, a new multilateral European order will rise — one that “restores sovereignty, freedom and direct democracy” (New World Order style). <<<<<<

Speaking of the political right and Nigel Farage’s buddy Panos Kammenos…

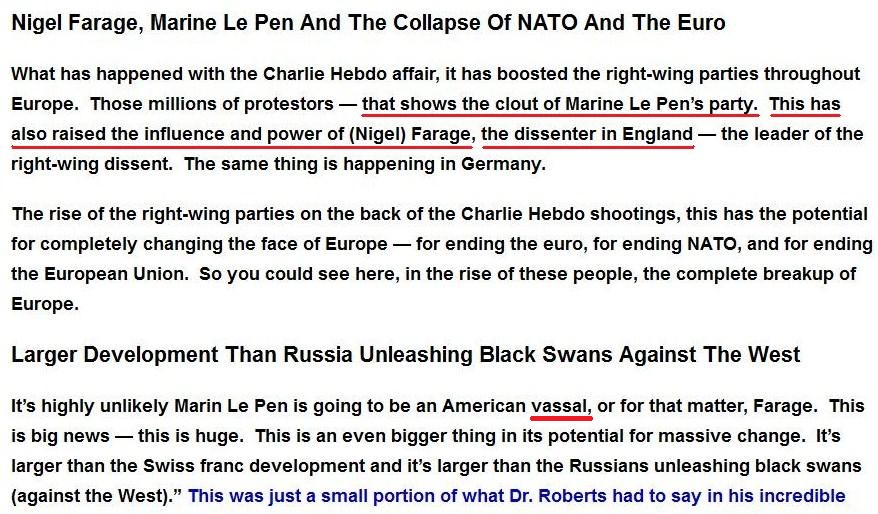

….let’s recall something Paul Craig Roberts wrote in the aftermath of the Paris “terror” attacks…

…(This excerpt came from this King World News article which was covered in Update 7).

So here is PCR promoting the political right / Mises Mafia as the ones who will end European “vassalage.” They are the globalists’ Right Hand which will sweep in to bring order after the Left Hand brings chaos.

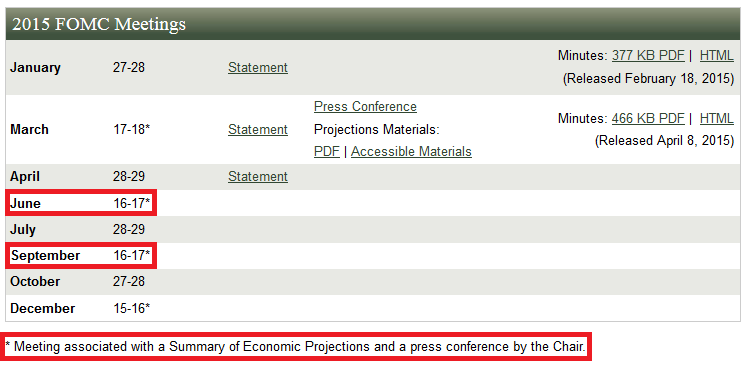

So as I look upon June, this is what I currently anticipate…

1) Greece will likely default by June 18.

2) Greek bank runs, which are already forming, will intensify.

3) The European Central Bank will block Greece from gaining any increase in their Emergency Liquidity Assistance (the lifeline that is keeping Greek banks solvent). They will do this under the pretense of pressuring the Greeks to come to terms with the Troika by the end of the month, but their real purpose is to intentionally topple the Greek banking system.

4) There will be a Greek “bank holiday” and a general economic convulsion.

5) The searingly painful economic convulsion will prompt the Greeks to recoil from the source of the burn (the Troika and Syriza). This will trigger the reflexive jump towards Kammenos and the BRICS.

[Update 27 – 2 June 2015]

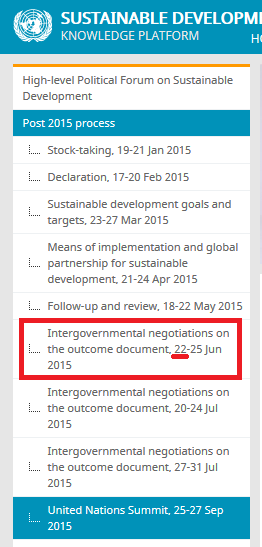

The globalists activate the Russian pipeline contingency

I took my son out to the movies this morning, and I came back to this…

…This news puts the rumored Russian advance pipeline payment to Greece back in play, which opens this contingency:

Given that all of the Greek external payments before July 19 go to the IMF (not any European institutions), the Greeks could bundle those IMF payments and pay them using a Russian advance. This would mean there’d be no default before the BRICS Summit / New Development Bank launch on July 8-9, where the Greeks could secure further financing. An economic development package from the NDB could afford Greece the freedom to partially or wholly stiff the Europeans on July 19.

That being said, this does nothing about Greek dependence on the ECB’s Emergency Liquidity Assistance. By capping, reducing or eliminating those funds, the globalists can topple Greece’s banks at any time. Just think of how good the Russians would look if they “saved Greece from default,” then think of how bad the EU would look if they toppled Greece’s banking system anyway “out of spite.” It would fit right into the Bad West / Good East dialectic circus.

I will write in more detail about this scenario in the next update. For the previous updates from this series, click here.

Till later, much love…