[Update 12 – 25 January 2015]

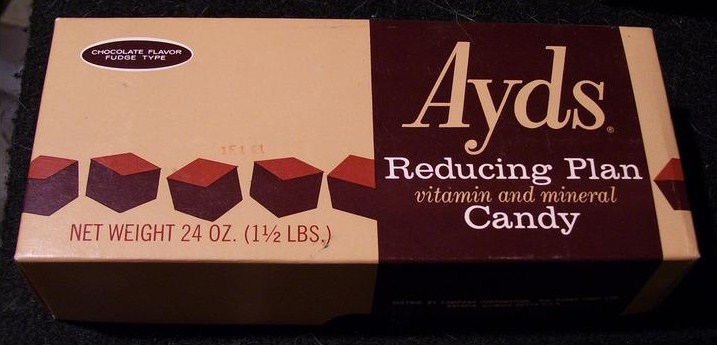

How would you like a mouthful of Ayds?…

…Probably about as much as you want to be financially ruled by the IMF and the BIS, and the globalists know this.

When I was young, I remember seeing commercials for the weight loss chews pictured above. Their Wikipedia entry tells what happened to them…

“Ayds (pronounced as “aids”) was an appetite-suppressant candy which enjoyed strong sales in the 1970s and early 1980s…

By the mid-1980s, public awareness of the disease AIDS caused problems for the brand due to the phonetic similarity of names. While initially sales were not affected, by 1988 the chair of Dep Corporation announced that the company was seeking a new name because sales had dropped as much as 50% due to publicity about the disease. While the product’s name was changed to Diet Ayds (Aydslim in Britain), it was eventually withdrawn from the market.”

As you can imagine, the public formed negative associations with the name of the product, so the manufacturer recognized the need to change it. The problem was that they didn’t change it enough to get rid of the bad associations. As we head into the public debut of the multilateral / multipolar New World Order, it’s important to note that many of the globalist brands (such as the IMF and the Bank for International Settlements) have also garnered negative associations, so don’t be surprised if they move their offices and change their nameplates when the system resets.

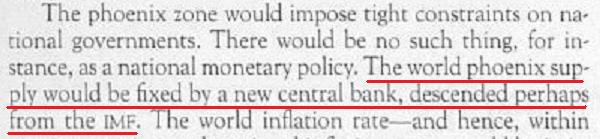

If we look back to the 1988 Economist article “Get ready for the phoenix,” we see that it hints at the replacement of the existing IMF brand with something new…

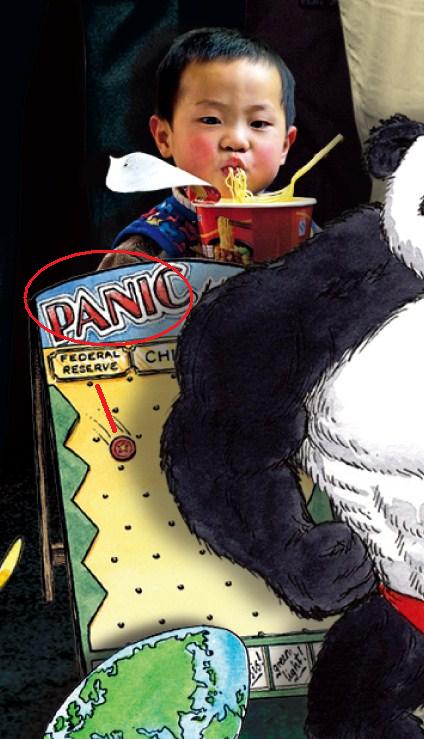

So what will be the name of the new world central bank? They probably won’t call it “The Illuminati Central Bank” because they’ll want to avoid using words in the name that have bad associations in the public consciousness. Words like “global(ist),” “bank,” “central bank,” “authority,” etc. will likely be omitted and benign-sounding words will be used instead. The name might be “The New Monetary Council” or something along those lines.

As for other globalist entities, the Bank for International Settlements might be renamed something like “The Financial Coordination Council” and the UN’s World Bank might be folded into the BRICS-founded “New Development Bank” (which might explain why they left “BRICS” out of the name). If you think about it, how hard is it for the globalists to take the BIS and World Bank coversheets off of their reports and planning documents and replace them with new FCC and NDB coversheets? Not hard at all.

The replacement of tainted existing brands by fresh new brands extends beyond globalist organizations of course; it includes political figures as well. Many of the leaders people associate with the current crises (the scapegoats) will be swept aside by “heroic” controlled opposition figures who “saw it all coming” and could have prevented it “if only we’d had the power.”

As I’ve shown in previous entries, the globalists seem to be positioning the “right wing dissenters” to take the political stage after the transition. This is symbolically appropriate given the whole Left Hand/Right Hand approach of the “elite.” They use the Left Hand to cause chaos and destruction and the Right Hand to bring about order and construction. It is for this reason that they’ve carefully built-up a public image of foresighted/conscientious dissent for “right wing” figures like Marine Le Pen, Nigel Farage, Ron Paul, Rand Paul, and Ted Cruz. They have also done this for “left-winger” Elizabeth Warren, so she must have some role to play in bringing the “political left” into the fold after the transition.

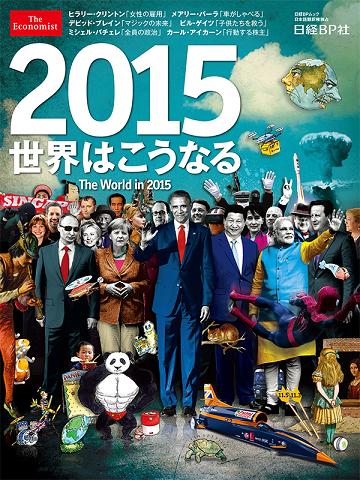

All this being said, we are heading into the biggest mind f*ck that has ever been foisted upon the human race. The “elite” will be “changing the guard,” so expect them to make a big show of…

> “taking down the wrongdoers” (like they are in China right now). In reality, though, they are not taking down the corrupt; they are merely disposing of those who have outlived their usefulness or who “know where the bodies are buried.”

They might even make a show of scapegoating certain Western “elite” families that have become tainted in the public eye (such as the Rothschilds and the Rockefellers), but no real harm will come to them. That’s why disinfo agents like David Wilcock and Benjamin Fulford tell sob stories about how the Illuminati were abused as children (“so they shouldn’t be blamed for doing things they didn’t really want to do”) and suggest that the Illuminati face “truth and reconciliation commissions” rather than punitive criminal courts. The “elite” don’t mind having some of their Family members wear dark hats and play the fall guy, but they don’t want their Bloodline brethren actually harmed.

> “replacing corrupt institutions” (like I’ve explained in this entry). In reality, though, they’ll simply be moving their operations from one shell to another…

> and “building a fair economic system based on sound money.” In reality, though, you’ll find the asset/commodity backing of the new currencies to be more theoretical than actual, especially when it comes to “elite”-coveted gold.

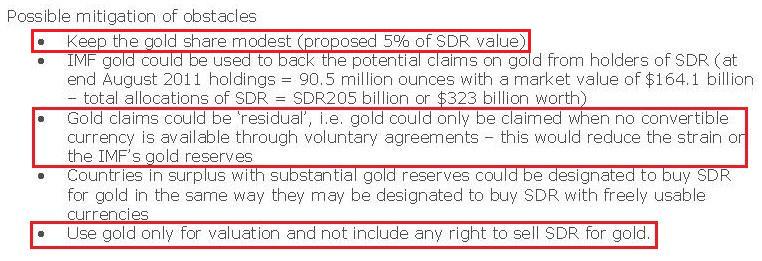

According to a Chatham House (the Royal Institute of International Affairs, a globalist think tank / propaganda center) paper titled Adding Gold into the Valuation of the SDR, these are some methods the banksters might use to keep the gold securely in their hands…

…So good luck trying to trade an SDR or national treasury note for physical gold.

Like I’ve said many times before, any global solution to our problems is a globalist solution. There is no other group of people who have the organization and power to erect a global solution at this time. So no matter what they call the new institutions or who they say are behind them, just look at what the institutions actually do. If they centralize power over your life at the global level, they are your enemies, no matter how nicely they might treat you at first.

And with that, I’ll call it a day. For the previous updates in this series, click here. To see all the updates, visit the Globalist Agenda Watch category.

Love always…