[Update 28]

The girl is Greece’s banks, and the safety lines are ELA…

…What happens if the ECB decides to cut them?

As we look upon the current Greek situation, it is important to remember that Greece’s banks are already broke, and they would have shut their doors months ago if not for the cash provided by the European Central Bank’s Emergency Liquidity Assistance (ELA) provision.

Put in simple terms, ELA provides protection against bank runs. As panicked customers take cash out of a troubled bank’s front door, ELA brings cash in through the back door so the bank doesn’t run out of money and shut down. And although ELA is extended to banks through their own national central bank (in this case, Greece’s central bank), the Governing Council of the ECB can shut it down at any time. This excellent February 4 Bloomberg article which explains ELA offers the following insights…

>>> Uncertainty over Greece’s future in the euro area triggered deposit outflows totaling more than 15 billion euros since the beginning of December. Also, Greek banks lost access to financial markets. ELA is their only lifeline allowing them to replace lost liquidity…

…the ECB’s Governing Council can restrict “ELA operations if it considers that these operations interfere with the objectives and tasks” of the euro-area system of central banks, or Eurosystem…

ELA… gives Greek banks support until the country and its creditors solve their financing issues and strike a deal. If uncertainty persists, and deposit outflows accelerate, the Governing Council may decide that the problem is not liquidity, but the solvency of lenders. And then ELA will stop. <<<

So if depositors keep taking cash out through the front door and ELA stops bringing cash in through the back door, what happens to the banks? They run out of money and close their doors of course, and the ECB has already stopped ELA from increasing even though deposit outflows are accelerating.

With rumors circulating of a Greek pivot towards the BRICS, and with the Troika offering their “final offer” to Greece today, will a Greek refusal be spun as “interfering with the objectives and tasks of the euro-area system of central banks”? Will reports of increasing deposit flight from Greek banks provide pretext for the ECB to declare that their problem “is not liquidity, but solvency”? Will ELA continue to be capped, or will it be reduced or eliminated? (It depends on how soon they want Greece to fall.)

On a historic side note, June 18 is the 200th anniversary of the Battle of Waterloo. It commenced with a French attack (at Hougoumont). Also, the number 18 is the sum of 6 + 6 + 6. Will the EU’s Waterloo begin with an attack on Greece’s banks on the 18th? Who knows, but it’s a date to watch. The ELA card can be played at any time starting today.

[I’ve added this scenario to the NWO Schedule of Implementation as Mod 1.5]

[Update 29 – 4 June 2015]

The IMF positions itself in advance of the “Fed Mistake”

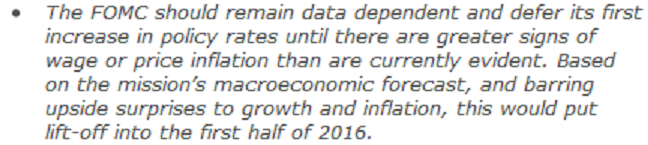

I saw a number of article this morning about the IMF advising the Federal Reserve to hold off on an interest rate hike till next year, so I tracked down the original IMF press release…

By giving this warning now, two weeks before the next FOMC meeting, the “wise,” supranational IMF are positioning themselves to be able to say, “We warned them it wasn’t the right time,” after the Fed hikes rates and triggers an economic shock. As I’ve mentioned in previous entries, the globalists are in the process of making their national-level central banks look stupid and their supranational institutions (the IMF and BIS) look genius so monetary power can be publicly centralized at the global level.

If you visit Zero Hedge (or any other alternative news aggregator) each day, you’ll see an endless stream of articles from various talking heads complaining about the stupidity and incompetence of the Fed and how the Fed’s “too loose for too long” monetary policy will lead to our destruction. The globalists have had their controlled-opposition agents drumming “Blame the Fed” into the public mind for years now. And once the next crisis comes along, this drumbeat will become deafening.

Of course, it isn’t even necessary for the Fed to raise rates in order to be blamed for what’s coming. But raising rates will be a very visible action which will lead to a very visible consequence, and this will make it easier to sell the Fed’s culpability to the public. A clear and current example of cause and effect is a great teaching tool.

[By the way, I’m not implying that Zero Hedge is controlled opposition, just the guys who write a lot of the articles they feature. To their credit, ZH frequently publishes articles by Brandon Smith, a writer who tells the truth about what’s really going on.]

[Update 30 – 4 June 2015]

Greece moves towards the Russian rescue scenario

It’s been announced that Greece will be bundling their IMF payments…

…from RTE News.

This means that another step has been taken towards the Russian rescue / EU smackdown scenario outlined in Update 27. Here is how I see them possibly playing this:

1) Greece will sign on to Russia’s Turkish Stream pipeline project at the St. Petersburg International Economic Forum (June 18-20) and receive an advance payment or loan for doing so. The payment/loan will be sufficiently large to pay Greece’s June and July IMF payments.

2) The EU will retaliate against Greece by shutting down Emergency Liquidity Assistance to Greece’s banks. Since the ELA provides over 80 billion euros to the Greek banking system, Russia and the BRICS won’t be able to stop a collapse. Bail-ins will take place.

3) As early as July 8, the BRICS’ New Development Bank will help Greece reboot its economy.

[Update 31 – 6 June 2015]

Bank runs and pipeline politics

It has been reported that the Greeks withdrew 700 million euros from their banks on Friday, which represents a major surge in their ongoing bank run. At this rate, the withdrawals will quickly overwhelm the existing ELA, and this raises an obvious question: “How will the ECB publicly justify providing the ‘uncooperative Greeks’ nearly a billion euros per day to keep the drama going?”

The globalists have already set up the public pretexts to deny Greece any further ELA. The Greek government rejected the Troika’s “final offer” on Friday, and Greece has publicly committed to Russia’s Turkish Stream pipeline. Since siding with the Russians on the pipeline issue goes directly against the EU’s energy security policy of developing alternatives to Russian gas, the ECB has all the justification it needs to put the brakes on ELA. Once that happens, we need only watch as the bank run floodwaters overtop the existing ELA sandbags.

One step that could be taken to slow the bank run is a formal announcement of a Russian advance on the pipeline, thus reassuring that the public that the IMF payment at the end of the month will be made. Again, though, this would be a public slap in the face to the EU and their energy policy, which is ample justification to halt ELA increases. So will the ECB allow the collapse to begin this week, or will they string this thing out till the 18th or July 1st? I can’t say for sure, but I’ll be stocking up on popcorn this Monday.

As we watch all this unfold, it is important to remember that the whole Greek situation is a dramedy put on for public consumption. Everyone in the play – the EU, the Greeks, and Russia – knows exactly what the globalist script calls for and is putting on a good show. The whole thing is a cover for the NWO agenda operating behind the scenes, so don’t get sucked in.

(P.S. – 6 June 2015) – I just realized that the St. Petersburg International International Economic Forum takes place Thursday, June 18 through Saturday, June 20. This means that the first day Greek banks will be open after the Forum will be Monday, June 22. Knowing the globalists’ affinity for 22, it is another day to watch.

For the previous updates from this series, click here.

With love…