For anyone who might still believe that the US/NATO versus Russia/BRICS geopolitical confrontation is real, here is a little blast from the past…

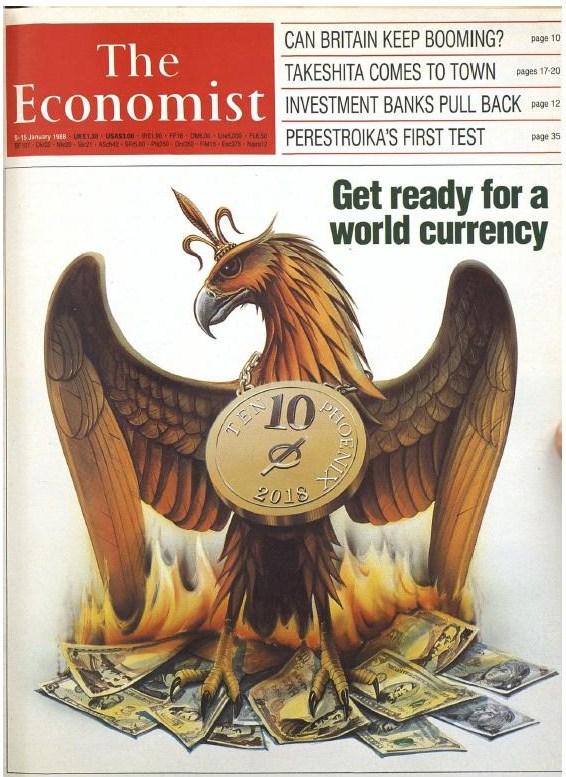

…It is the cover from the January 9, 1988 issue of The Economist magazine. Note the phoenix rising from the ashes of burning national currencies, including the dollar.

The cover relates to an article on pages 9-10 titled Get ready for the phoenix, which foretold the financial drama we are now watching unfold in real time. Upon stumbling across them, I found the cover art and the article so striking that I thought they might be an online forgery, so I verified their authenticity with a research librarian at the Newspaper and Current Periodical Room of the Library of Congress. Both the cover and the article are quite real. Here are some excerpts (not necessarily in the order in which they appear in the article)…

>>> THIRTY years from now, Americans, Japanese, Europeans, and people in many other rich countries, and some relatively poor ones will probably be paying for their shopping with the same currency. Prices will be quoted not in dollars, yen or D-marks but in, let’s say, the phoenix. The phoenix will be favoured by companies and shoppers because it will be more convenient than today’s national currencies, which by then will seem a quaint cause of much disruption to economic life in the last twentieth century…

…The phoenix would probably start as a cocktail of national currencies, just as the Special Drawing Right is today. In time, though, its value against national currencies would cease to matter, because people would choose it for its convenience and the stability of its purchasing power…

…The phoenix zone would impose tight constraints on national governments. There would be no such thing, for instance, as a national monetary policy. The world phoenix supply would be fixed by a new central bank, descended perhaps from the IMF…

…Governments are far from ready to subordinate their domestic objectives to the goal of international stability. Several more big exchange-rate upsets, a few more stockmarket crashes and probably a slump or two will be needed before politicians are willing to face squarely up to that choice…

…Pencil in the phoenix for around 2018, and welcome it when it comes. <<<

It’s all there: the SDR “cocktail” (basket) of currencies, the IMF’s central role, and the need to create “exchange rate upsets, stockmarket crashes, and economic slumps” to make the public accept it. Seeing such an accurate forecast/blueprint, one wonders who was behind its publishing. So if we look into The Economist magazine, we find it is headquartered just a few blocks from the City of London and is owned by The Economist Group, which itself is owned by some rather interesting characters…

“The Economist Group is 50% owned by Pearson PLC via The Financial Times Limited. The bulk of the remaining shares are held by individual shareholders including the Cadbury, Rothschild, Schroder, Agnelli and other family interests as well as a number of staff and former staff shareholders.”

Beyond the Rothschild and Agnelli families, who are widely rumored to be part of the Illuminati, the Schroder family is particularly worth noting. The Schroders (also spelled Schroeder) are an old German ruling class family from Hamburg. One of the Schroder brood, Johann Heinrich Schroder, settled in London and founded J. Henry Schroder & Co. (now known simply as “Schroders,” one of the UKs largest investment banks) back in 1818. Later, in 1923, the firm expanded into New York by establishing J. Henry Schroder Banking Corporation. It is here that they joined with the Rockefeller family through Avery Rockefeller.

According to Avery’s bio…

“In 1928, Rockefeller joined the storied J. Henry Schroder Banking Corporation and became Assistant Treasurer in 1931. On 8 July 1936, Rockefeller co-founded Schroder, Rockefeller & Co., Inc. Its purpose was to take over the underwriting and general securities business formerly carried out by the J. Henry Schroder Banking Corporation.”

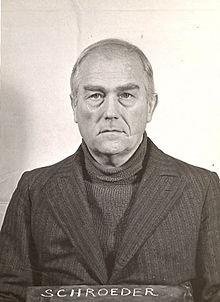

Schroder, Rockefeller & Co. is widely viewed as having been an integral part of the globalist bankers’ financial support infrastructure for the Nazis. And another of the Schroders, Johann Heinrich’s great-grandson, Baron Kurt von Schroeder (shown here in his Nuremberg picture)…

…played a pivotal role..

“Schroeder was an important member of the Freundeskreis der Wirtschaft, which provided Adolf Hitler and his party with enough financial support to survive through the early 1930s. He also hosted a critical meeting on 4 January 1933 between Papen and Hitler that eventually led to Hitler’s appointment as Chancellor of Germany.”

The Nazis had (and continue to have) deep ties to the Anglo-American banking establishment, and also to The Economist. So this article came from a publication connected to the supposed “Nazi/Zionist Cabal.” Keep this in mind as we take a look at what that Cabal’s supposed enemies, the Chinese, are saying about the currently-unfolding global financial drama.

The Blueprint Revealed

I recently ran across a China Daily article titled Bracing for next big financial crisis, written by Giles Chance (a former World Bank staffer who is a professor at the Guanghua School of Management at Peking University). I strongly recommend following the link and reading the entire article, because it succinctly lays out the globalist plans and talking points for the next economic crisis. Once you correct for the article’s spin, it tells you everything. Here are some select passages, with my commentary added in brackets…

>>> Above the central banks, including the PBOC [People’s Bank of China], stands the Bank of International Settlements in Basel, Switzerland, which oversees the activities of national banking and monetary systems. The integration of markets and economies in a globalized world has given the BIS an increasingly important role in providing global financial stability… <<<

[So here we have a Chinese propaganda organ telling us that the BIS is in charge of all the central banks, including China’s. This is in spite of the fact that the BIS was a joint creation of the London bankers and the Nazis (who are supposedly the bad guys the BRICS are fighting). I will share more about the BIS later in the article.]

>>> In 2007, the year before the financial crash, the BIS warned that the global financial system was becoming overstretched and that the banking systems in the developed world were coming under pressure. But although the BIS has great influence, it does not have the power to compel any central bank. It can advise and warn, but it cannot give orders, and it does not issue its own money. As we know, the Federal Reserve Bank of New York and the European Central Bank in Brussels did not act on the well-timed warning from the BIS. <<<

[This passage establishes the BIS’s wisdom and foresight, as opposed to the foolishness of the national central banks. It also carries the implication that the BIS should be given the power to compel the national central banks to follow its wise guidance. Not mentioned is the fact that the financial crash was deliberately triggered by the very bankers he’s writing about, and that the foolishness of the national central banks’ responses was quite calculated. It allowed the banksters to harvest enormous wealth from the public and set up the pretext for the global institutions to step in and “provide stability.”]

>>> Against that background, you would expect today that if the BIS issued another warning, the world would pay attention. At the end of June, BIS General Manager Jaime Caruana gave a speech at its headquarters that contained a strong note of caution: “A new policy compass is needed to help the global economy step out of the shadow of the global financial crisis…” <<<

[By “a new policy compass,” he means a transition from the current dollar-based global financial system to the new, more centralized SDR-based multipolar/multilateral financial system]

>>> In his speech, Caruana blamed the continued dependence by the advanced economies, led by the United States, on ultra-loose monetary policy in place of the necessary deep-seated structural changes. <<<

[Here, he’s setting up the Federal Reserve (and the EU and Japan) to take the blame.]

>>> Caruana’s warning was reinforced by William White, head of the Economic Review and Development Committee at the headquarters of the Organization for Economic Co-operation and Development in Paris. As one of the very few experts who accurately forecast the 2008 crash, while head of research at the BIS, White is listened to with respect around the world.

In a recent interview, he said: “Riskfree bond rates are at enormously low levels, spreads are very low … it all looks and feels like 2007. And frankly, I think it’s worse than 2007…” <<<

[Here, another “wise” person from the BIS is warning that we’re approaching another financial crisis (that he and his buddies are engineering). It’s pretty easy to be a forecaster when you’re in on the plan. So if this year looks and feels like 2007, will next year be the next 2008?]

>>> But the US Federal Reserve Bank, the controller of the dollar-based global economy, does not agree with the BIS or William White. Several days after Caruana’s speech, Fed Governor Janet Yellen made it clear that she does not think that extremely low interest rates were the main culprit in the 2008 financial crisis, nor constitute the main problem now. <<<

[This is a very instructive passage. Note how the author specifically mentions the “dollar-based global economy.” Also note how he again paints the Federal Reserve as the morons who won’t listen to the sage globalists at the BIS. In this, he is setting up Janet Yellen for her upcoming scapegoat role, and he is tying interest rates to what will bring her down. The author says all this while failing to disclose that Janet Yellen is a member of the Board of Directors of the BIS, as is PBOC governor Zhou Xiaochuan]

>>> The disagreement between these two powerful financial institutions, the BIS and the New York Federal Reserve, has increased the risk that markets will crash as interest rates rise. Can China’s stability withstand another financial crash? Or would China emerge stronger? <<<

[Bingo! Here we are shown the trigger for the next financial crisis: Yellen will raise interest rates either “too soon” or by “too much” and crash the markets. “If only the wise BIS had had the power to rein in the Fed’s foolishness sooner, we could have avoided this,” they’ll say. 🙂 Now let’s read on and see if China will emerge stronger.]

>>> China certainly has economic problems… But the forward-looking, courageous determination of its government to grasp some important nettles in its economic reform program will make it a key part of any solution to another Western financial crisis. <<<

[Here, the author does the requisite ass-kissing to his Chinese hosts, then boldly states that China will be “a key part of any solution to another Western financial crisis.” Solution, as in problem – reaction – solution. And the article has already shown us who caused the problem part of the equation: the unruly Western central banks, especially the Fed.]

>>> With the BIS and the US Federal Reserve Bank on opposite sides of the fence about global financial stability, the likelihood of another global financial crisis grows. But next time would indeed be different, because Western taxpayers would refuse to pay for another huge bank bailout, as they did in 2008-09. <<<

[So again, in case you missed it: BIS = good = wise = solution and US Federal Reserve Bank = bad = problem = another global financial crisis.]

>>> The emerging world, led by China, is economically in a much stronger position relative to the advanced countries than six years ago. Although in 2009 China may not have expected its sudden promotion to world power status, the country’s emergence since the crash as a global pillar of growth has significantly increased its global influence. <<<

[China didn’t expect its promotion to world power status? Au contraire, they knew it was coming because the globalists promised it to them, just like they promised what comes next…]

>>> Another crash on Wall Street would reinforce the attraction of the renminbi as a store of value and anchor of stability for other regional currencies…

It would underpin China’s global appeal as a peaceful force for stability in a volatile and troubled world, and hasten the re-engineering of shareholding in the major organizations of global governance, particularly at the World Bank and the IMF. Prepared or not, in the event of another crash China would find itself in a position of even greater global leadership and responsibility than today. <<<

[So here we are told that the next crash will be China’s gateway to top dog status, and it will “hasten the re-engineering of shareholding in the major organizations of global governance, particularly at the World Bank and the IMF.” This is exactly what I’ve been warning about. When the next crash comes, watch them break out their gold and other commodities to underwrite the global financial system in exchange for the governance changes.]

Now that we are done de-spinning the article, there are two things it brings up that deserve to be examined: the BIS and the Fed’s raising of interest rates…

The Bank for International Settlements (BIS)

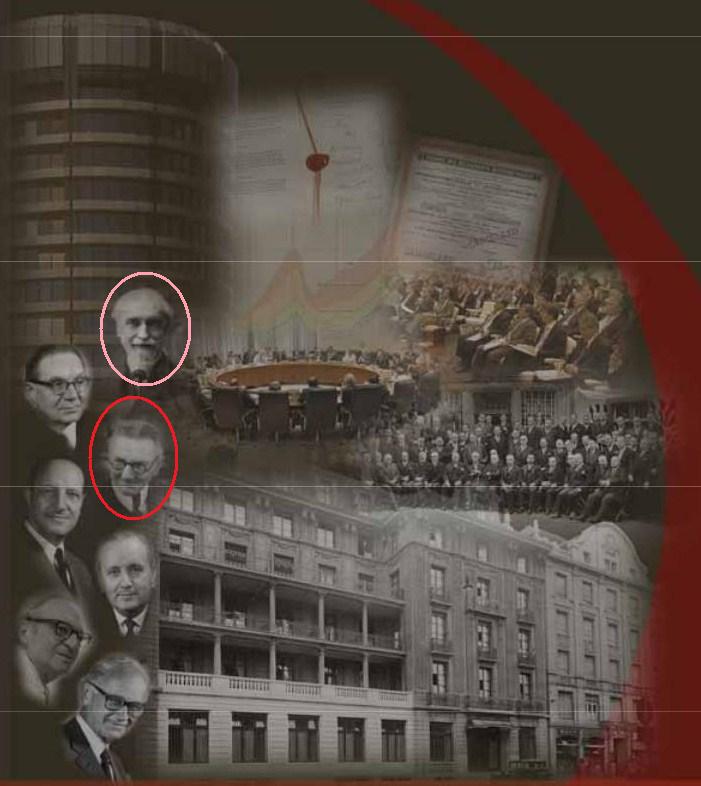

This is the cover art for the BIS Archive Guide…

…It proudly features Montagu Norman (the Bank of England Governor from 1920-1944, circled in pink) and Hjalmar Schacht (the President of the Reichsbank from 1923-31 and 1933-39, and Hitler’s Economics Minister from 1934 – 1937, circled in red). You’ll hear more about these two a little later in the article. But first, let’s have a look at a little piece of BIS history…

>>> Between 1933 and 1945 the BIS board of directors included Walther Funk, a prominent Nazi official, and Emil Puhl, who were both convicted of war crimes at the Nuremberg trials after World War II, as well as Hermann Schmitz, the director of IG Farben, and Baron [Kurt] von Schroeder, the owner of the J.H.Stein Bank, which held the deposits of the Gestapo. There were allegations that the BIS had helped the Germans loot assets from occupied countries during World War II.

As a result of these allegations, at the Bretton Woods Conference held in July 1944, Norway proposed the “liquidation of the Bank for International Settlements at the earliest possible moment”. This resulted in the BIS being the subject of a disagreement between the American and British delegations. The liquidation of the bank was supported by other European delegates, as well as the United States (including Harry Dexter White, Secretary of the Treasury, and Henry Morgenthau), but opposed by John Maynard Keynes, head of the British delegation.

Fearing that the BIS would be dissolved by President Franklin Delano Roosevelt, Keynes went to Morgenthau hoping to prevent the dissolution, or have it postponed, but the next day the dissolution of the BIS was approved. However, the liquidation of the bank was never actually undertaken. In April 1945, the new U.S. president Harry S. Truman and the British government suspended the dissolution, and the decision to liquidate the BIS was officially reversed in 1948. <<<

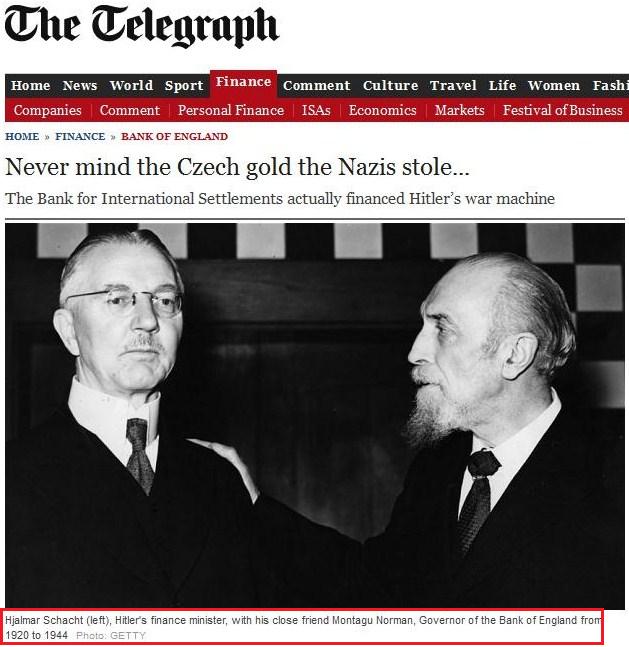

So why were the British bankers so opposed to shutting down a bank with strong Nazi ties, you ask? Well, have a look at this UK Telegraph article (use this Internet Archive link if the direct link isn’t working)…

I recommend reading the whole article, as it contains more juicy information than I can include in this post. Here are the most relevant excerpts for the topic at hand (with my comments in brackets)…

>>> The BIS was founded in 1930, in effect by Montagu Norman and his close friend Hjalmar Schacht, the former president of the Reichsbank, known as the father of the Nazi economic miracle. Schacht even referred to the BIS as “my” bank. The BIS is a unique hybrid: a commercial bank protected by international treaty. Its assets can never be seized, even in times of war. It pays no taxes on profits…

A key sentence in the Bank of England documents is found on page 1,295. It reads: “The general attitude of the Bank of England directors of the BIS during the war was governed by their anxiety to keep the BIS to play its part in the solution of post-war problems”… [the bankers created the problem (World War 2), and they used the BIS to institute their solution (more centralized control of the world’s financial systems)]

…And here the secret history of the BIS and its strong relationship with the Bank of England becomes ever more murky.

During the war the BIS proclaimed that it was neutral, a view supported by the Bank of England. In fact the BIS was so entwined with the Nazi economy that it helped keep the Third Reich in business. It carried out foreign exchange deals for the Reichsbank; it accepted looted Nazi gold; it recognised the puppet regimes installed in occupied countries, which, together with the Third Reich, soon controlled the majority of the bank’s shares.

Indeed, the BIS was so useful for the Nazis that Emil Puhl, the vice-president of the Reichsbank and BIS director, referred to the BIS as the Reichsbank’s only “foreign branch”…

Every other month it hosts the Global Economy Meetings, where 60 of the most powerful central bankers, including Mark Carney, Governor of the Bank of England, meet. No details of meetings are released, even though the attendees are public servants, charged with managing national economies.

The BIS also hosts the Basel Committee on Banking Supervision, which regulates commercial banks, and the new Financial Stability Board, which coordinates national regulatory authorities. The BIS has made itself the central pillar of the global financial system. <<<

Speaking of these Global Economy Meetings, guess who attends them? According to the BIS website…

“The GEM comprises the Governors of 30 BIS member central banks in major advanced and emerging market economies that account for about four fifths of global GDP. The members of the GEM are the central bank Governors from Argentina, Australia, Belgium, Brazil, Canada, China, France, Germany, Hong Kong SAR, India, Indonesia, Italy, Japan, Korea, Malaysia, Mexico, the Netherlands, Poland, Russia, Saudi Arabia, Singapore, South Africa, Spain, Sweden, Switzerland, Thailand, Turkey, the United Kingdom and the United States and also the President of the European Central Bank and the President of the Federal Reserve Bank of New York. Governors from several other central banks attend the GEM as observers.”

So as you can see, beyond the public theater offered in Ukraine and the Middle East, and beyond all the East versus West propaganda offered in the mainstream and alternative media, China and the BRICS are dancing to the tune of the BIS puppetmasters just like everyone else. There is NO CONFLICT between “Nazi/Zionist” transatlantic bankers and BRICS bankers. In fact, Chinese and Russian banks (along with everyone else) are in the process of implementing the Basel 3 bank reforms put out by the Basel Committee on Banking Supervision, which is hosted by the BIS.

According to this China Daily article…

“Under China’s implementation of Basel III guidelines, systemically important banks need a minimum Tier 1 capital ratio of 9.5 percent, with total buffers of 11.5 percent, before the end of 2018.”

…and according to this Russia Today article…

“Basel III – a new set of global banking standards scheduled to come into force in Russia this year – should become another stimulus for the country’s lenders to rely on its own funds rather than State support. One of the key Basel III requirements is tighter rules for a banks’ own capital.”

The whole East versus West propaganda campaign is aimed at giving the hypnotized public a fairytale storyline for all the changes they’re going through. It also offers them scapegoats on whom they can pin all their problems. The international bankers are going to crash the current system and blame it on the Federal Reserve, then they’re going to introduce the BRICS as the heroes who save the day.

In fact, part of the purpose for the recent creation of the BRICS Bank is to give the BRICS a lifeboat while the West founders from the crash. The BRICS Contingent Reserve Arrangement…

“is a framework for the provision of support through liquidity and precautionary instruments in response to actual or potential short-term balance of payments pressures.

The objective of this reserve is to provide protection against global liquidity pressures. This includes currency issues where members’ national currencies are being adversely affected by global financial pressures.

The Bank would also provide assistance to other countries suffering from the economic volatility in the wake of the United States’ exit from its expansionary monetary policy.“

All this being said, when will the crash begin, and how long will it last? Given that the last crash lasted from 2007-2009 and contained a shocking “Lehman Moment,” it stands to reason that the next crash would also be a slow-motion train wreck with an even more shocking Lehman Moment. If the propaganda setup for the collapse is any indicator, the train wreck and New Lehman Moment will involve the raising of the Fed interest rate by Janet Yellen and perhaps a black swan event like a false-flag cyberattack or terrorist attack.

Looking at the interest rate component, the Fed will be meeting this Tuesday and Wednesday (September 16-17), and that could give us an indication of when things might kick off. The general consensus of the Fed watchers seems to be that interest rates will go up starting in the summer of 2015, with some estimates saying as early as March 2015. Will this start the train wreck? And since the BRICS bank isn’t scheduled to start lending until 2016, the New Lehman might not happen till then. But then again, they can always surprise us.

[Update 1 – 18 September 2014]

I’ve published a new article that is an extension of this one, so in case you haven’t read it yet, here it is: The IMF and the Mainstream Media are following the “Blame the Fed” Script.