Given all the things the globalists set in motion in the final few months of last year, as well as all the preparatory propaganda they laid down in December, I’ll be going to an event watch format so I can be more agile in keeping up with them. For today, I thought I’d share a preface Brandon Smith wrote for an article over on Alt-Market.com…

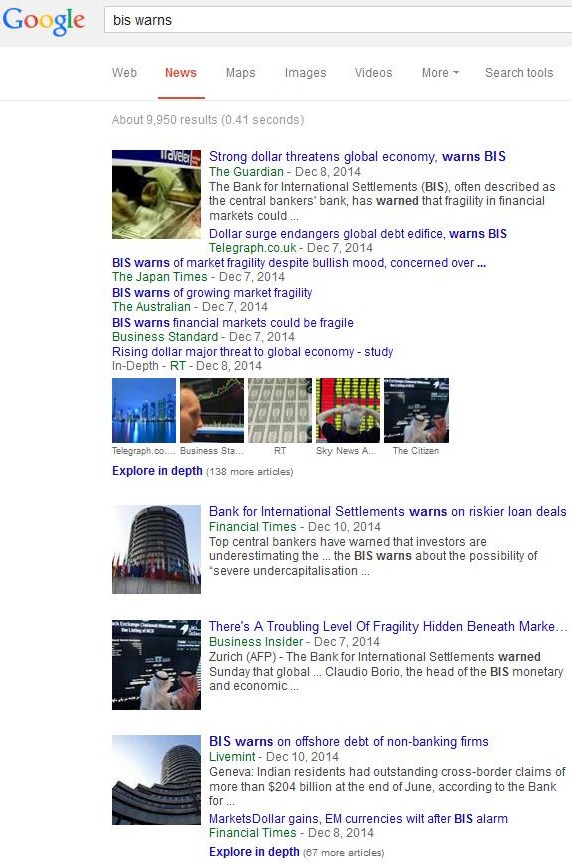

Brandon is one of the few (if not the only) financial writers out there who… A) get it, and B) have the guts to write about it. Not only is he dead-on about the BIS playing the wise man to the national central banks’ fool, but the BIS is also chiming in on the “strong dollar” as well. Just have a look at what I got when I did a Google News search on the terms “BIS warns”:

…and this is just the top part of the first page of results. They are setting themselves up to be the wise supranational institution that “saw it all coming” and could have prevented it “if only we’d had the power to rein in the national central banks.”

As you look upon the search results, note how they are warning about the strong dollar, and the propaganda press is writing stories about it too. They are basically setting the stage for transitioning to the SDR as the global reserve currency. This is their basic argument:

1) The sudden strength of the dollar is putting pressure on other nations who have taken out loans denominated in dollars. When the dollar gets stronger, it takes more of their currency to purchase each dollar they need to pay back their loans, which creates great difficulty for those with restricted budgets. For example, a $1 million loan payment would have cost a Russian about 33 million rubles to pay back in July of last year; to pay it this month will cost about 58 million rubles.

2) If only we had a supranational currency that was stable in value, difficulties like this could be avoided. We wouldn’t have to worry about fluctuations between the values of national currencies.

What the BIS central bankers don’t tell you, of course, is that they are the ones intentionally causing volatility in the exchange rates in order to profit from trading them. They are creating the problem that they are proposing to solve (by giving themselves even more power).

Few people know that the BIS’s Board of Directors is actually made up of the very central bank heads it’s criticizing. Here are three of them who will get a lot of heat from BIS propaganda when things go south: the previous head of the Bank of Japan, Masaaki Shirakawa; the current head of the Federal Reserve, Janet Yellen; and the current head of the European Central Bank, Mario Draghi…

…Do you really think the BIS and the members of the BIS Board of Directors are in disagreement with each other? Of course not. They are simply putting on a show of incompetence at the national level and competence at the supranational level so power can be centralized.

For a more in-depth look at the BIS and their strategy, read this entry: Mainstream globalist propaganda reveals East/West conflict is a farce.

More to come in Update 1…

[Update 1 – 3 January 2015]

BRICS Propaganda and the BIS

In “Mainstream globalist propaganda reveals East/West conflict is a farce,” I took an in-depth look at a BIS-related propaganda article from state-owned China Daily, so let’s now take a look at a recent propaganda piece out of government-funded RT…

Here are some key excerpts (with my comments in brackets)…

“A study by the Bank for International Settlements (BIS) suggests dollar dominance could spell disaster for emerging markets.

The spectacular recovery by the US dollar could ruin emerging market economies that have large dollar-denominated debts, which in turn could trigger chaos in the global financial markets, the Swiss-based global watchdog said…”

[In case you didn’t get the message they’re trying to convey, here it is: dollar dominance = disaster, especially for the “emerging market economies” to whom the globalists are marketing the BRICS institutions. And the BIS, a joint creation of the English banksters and their Nazi buddies, is the “global watchdog” (substitute “mad” for “watch” and you’ll be closer to the truth).]

“The Bank for International Settlements, dubbed the bank for central bankers, warns of the imbalance between dollar debt and dollar output, and said it could have a ‘profound impact on the global economy.’…”

[So dollar dependence could lead to “chaos in the global financial markets,” which could have a “profound impact on the global economy” (thus leaving the hanging implication that we need to move on to some alternative to the dollar, like the SDR).]

“A tightened monetary policy by the US Federal Reserve, paired with the strong dollar, could exacerbate debt problems in emerging markets.

A strong dollar, as pointed out by Borio, can raise debt burdens for countries with weaker currencies, as a strong dollar has historically triggered turmoil in emerging markets, such as in Latin America in the 1980s, and Asia in the 1990s.”

[So it’s also the monetary policy of the Federal Reserve that is creating problems for the emerging markets (“Blame the Fed” and “Sieg Heil, BIS”).]

After going on to bemoan the “outdated” dominance of the dollar as the primary global reserve currency, they offer the globalist solution to the problems posed by the strong dollar and the Fed’s policies…

As I’ve noted in previous entries, the globalists have intentionally instigated Western misconduct and market volatility in order to drive the rest of the world into the waiting arms of the BRICS institutions. In fact, the BRICS’ New Development Bank will have a safety net ready for the emerging economies once things get dicey. It’s called the Contingent Reserve Arrangement…

“The Bank would also provide assistance to other countries suffering from the economic volatility in the wake of the United States’ exit from its expansionary monetary policy.”

Of course, loans from globalist multilateral institutions always come with strings attached. 😉

The article then goes on to point to the light at the end of the dollar dominance tunnel…

…China and its yuan.

[Update 2 – 4 January 2015]

What East versus West conflict? The West is helping China’s renminbi to become a reserve currency

Continuing our review of globalist preparatory propaganda, let’s have a look at a Financial Times article titled “IMF decision could propel renminbi past sterling and yen” from December of last year (you’ll have to do a Google News search for the title to read the full article)…

It was written by Jukka Pihlman…

…who has strong central bankster connections.

Here are some notable excerpts…

>>> Last time the IMF reviewed the composition of the SDR, in 2010, it concluded the RMB did not meet the key criteria of being a freely usable currency. But a lot has changed since, making next year’s decision much more finely poised…

Nevertheless, the fast-paced adoption of the RMB by central banks and the inclusion of RMB in their reserves – underpinned by the Chinese authorities’ continued and conscious efforts in making the RMB more accessible – could help swing the IMF decision in the RMB’s favour.

The final decision is in part discretionary and politics will invariably play a part. But supporters of the RMB’s inclusion may draw comfort from the fact that changes to the SDR composition are relatively ‘easy’ to vote through.

Most big IMF decisions require an 85 per cent majority, effectively giving the US, with its almost 17 per cent share of the vote, the power of veto. However, according to Article XV of the IMF’s Articles of Agreements, the IMF Executive Board can make the SDR decision with only 70 per cent of the vote, provided there is no change to the methodology.

Importantly, the Europeans have indicated by their actions that they are unlikely to stand in the RMB’s way, as long as the technical argument stacks up. Recent reports that the European Central Bank was considering adding the RMB to its reserves, joining France and Switzerland who have already decided to do so, is a highly significant development and shows how rapidly attitudes to the RMB are changing. <<<

So in this article, we have a Western globalist minion telegraphing that the RMB will be added to the SDR this year. Not only that, he points out that the Europeans are welcoming the RMB as a reserve currency by adding it to their own central bank reserves. The article also mentions England’s selling of RMB-denominated bonds…

Here is an excerpt from the UK government’s website…

>>> The UK government has today successfully issued a sovereign bond in China’s currency, the renminbi (RMB), becoming the first western country to do so and issuing the largest ever non-Chinese RMB bond.

The RMB 3 billion bond, which is equivalent to approximately £300 million, has a maturity of 3 years and delivers on the Chancellor’s announcement at the recent annual UK-China economic summit in London that the government intended to issue an RMB bond.

It is the world’s first non-Chinese issuance of sovereign RMB debt and will be used to finance Britain’s reserves. Currently, Britain only holds reserves in US dollars, euros, yen and Canadian dollars, so today’s issuance signals the RMB’s potential as a future reserve currency.

The bond issuance, which saw strong demand from investors, also further cements Britain’s position as the most important RMB market in the western world, and represents the next step in the government’s long term economic plan to establish Britain as the centre of global finance. <<<

And everyone seems to overlook that a former People’s Bank of China Deputy Governor is now a Deputy Managing Director of the IMF…

…who will most likely be joined by his former PBOC boss, Zhou Xiaochuan, when the latter takes over as Managing Director of the IMF once the trigger is pulled on “governance reform.”

So where is the East versus West clash all the mainstream and alternative propagandists are talking about? It doesn’t exist, except as a propaganda ploy to make the multilateral / multipolar NWO look like real, positive change.

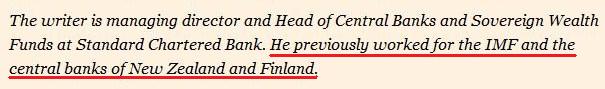

As for when the renminbi might be added to the SDR, let’s look to the globalist meeting schedule for this year. The G20 finance ministers and central bank governors will be meeting on February 9…

…so expect to hear a lot of noise in late January / early February about the need to go to “Plan B” due to “the United States’ failure to uphold its responsibility to adopt quota reform” at the IMF. There will be talk of dismantling the US’ veto power in the IMF as well as bringing the renminbi into the SDR basket of currencies.

The IMF/World Bank Group will have meetings on April 17 and October 9…

…so they will probably announce specific plans for quota reform and the RMB in April and take action by October 11. This would sync well with the BRICS Bank / economic collapse / Fed takedown timetable outlined in The Globalists are accelerating the rollout of their new financial system.

[Update 3 – 5 January 2015]

This episode of “Bend over, here it comes” is brought to you by Citibank

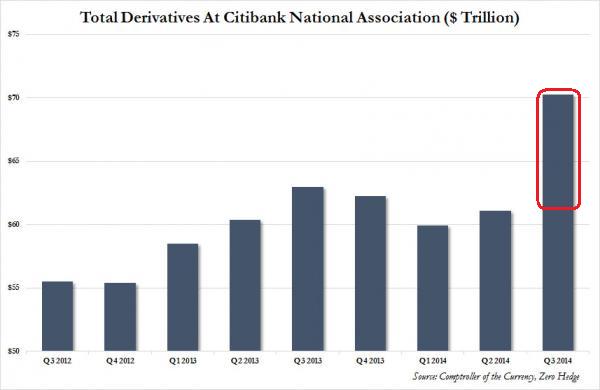

I’ll have to take a break from China and the IMF so we can take a look at something that just popped up on Zero Hedge: Is Citi The Next AIG?

Apparently, data was released today that showed an FDIC-insured entity of Citibank added a massive volume of derivatives to its books in the 3rd quarter of last year…

…And conveniently, Congress passed Citi-backed legislation last month that left taxpayers on the hook for any derivatives that go bad in such entities.

So here we have a case of the banksters loading up trillions of dollars of potentially bad contracts on the taxpayers just prior to what? Given the wave of derivative “credit events” that could be coming due to the strong dollar and the sudden drop in oil prices, are they going to trigger the global economic train wreck before the Fed can do it by raising interest rates? If so, don’t worry, the Fed will be blamed no matter what they do or don’t do.

This is not a year when you want to take life too seriously. 😉

Back to China and the IMF in the next update…